The quality of life and business is better when people know and learn how to manage their financial resources.

Financial literacy, which is acquired through adequate learning of financial concepts and consistently practising them, is a very important skill the female gender should excel in.

Women are known to be better financial managers than men; but as caregivers, they are daily faced with the challenge of effectively managing money, even in the midst of other priorities that life offers. Financial literacy lessons for women will be based on the need for proper channelling of their individual funds to their personal and business development.

A research conducted by women activists revealed that 60 per cent of what a woman earns goes into family maintenance, while 80 per cent of what most men earn are used to handle issues outside the family like building of businesses.

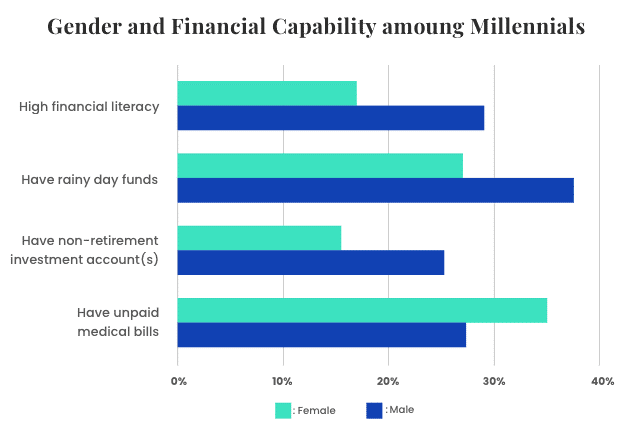

Credit: www.annuity.org

The failure of most women-led Small and Medium-sized Enterprises and startups is not due to lack of financial resources; rather, it is due to their inability to manage their little financial resources.

Historically, women are known to be small income earners due to their lack of access to proper education, caused by societal beliefs that do not encourage women to further their education to enable them build a proper career that will pay them more. Hence, they participate less in the society’s workforce, and if one is to scale above that barrier, it will require extra struggle.

This means that the society in which we find ourselves has indirectly structured the woman to be more family-conscious than self-conscious.

The financial strength of women is daily measured and limited, taking the wind out of their sails. This is why many women-led SMEs are not blossoming as expected.

Some benefits of financial literacy on female entrepreneurs

- Financial literacy equips the woman with the skill to identify and avoid bad financial deals.

- Basically, financial literacy ensures that every woman’s financial decision is backed by a rationale that empowers her to feel confident and secure in her choice.

- Being financially literate will enable the female gender to have more control over her personal finance and not be emotional when dispensing funds, which will save her from incurring debts, as it has negative effects on her business.

- Financial literacy helps the female gender to have a defined goal, which they prepare a budget for.

GoDo Hub, a Creative space startup initiative, having understood the benefits that financial literacy will offer the female gender, has designed capacity building financial literacy programme for Women in MSMEs.

You can donate to, collaborate with, or support this programme as part of your organisation’s Corporate Social Responsibility.